Veteran Trader Peter Brandt Claims Bitcoin Price Reaching $200K Is Unlikely: Here’s His Explanation

Peter Brandt’s Cautious Outlook on Bitcoin’s Future

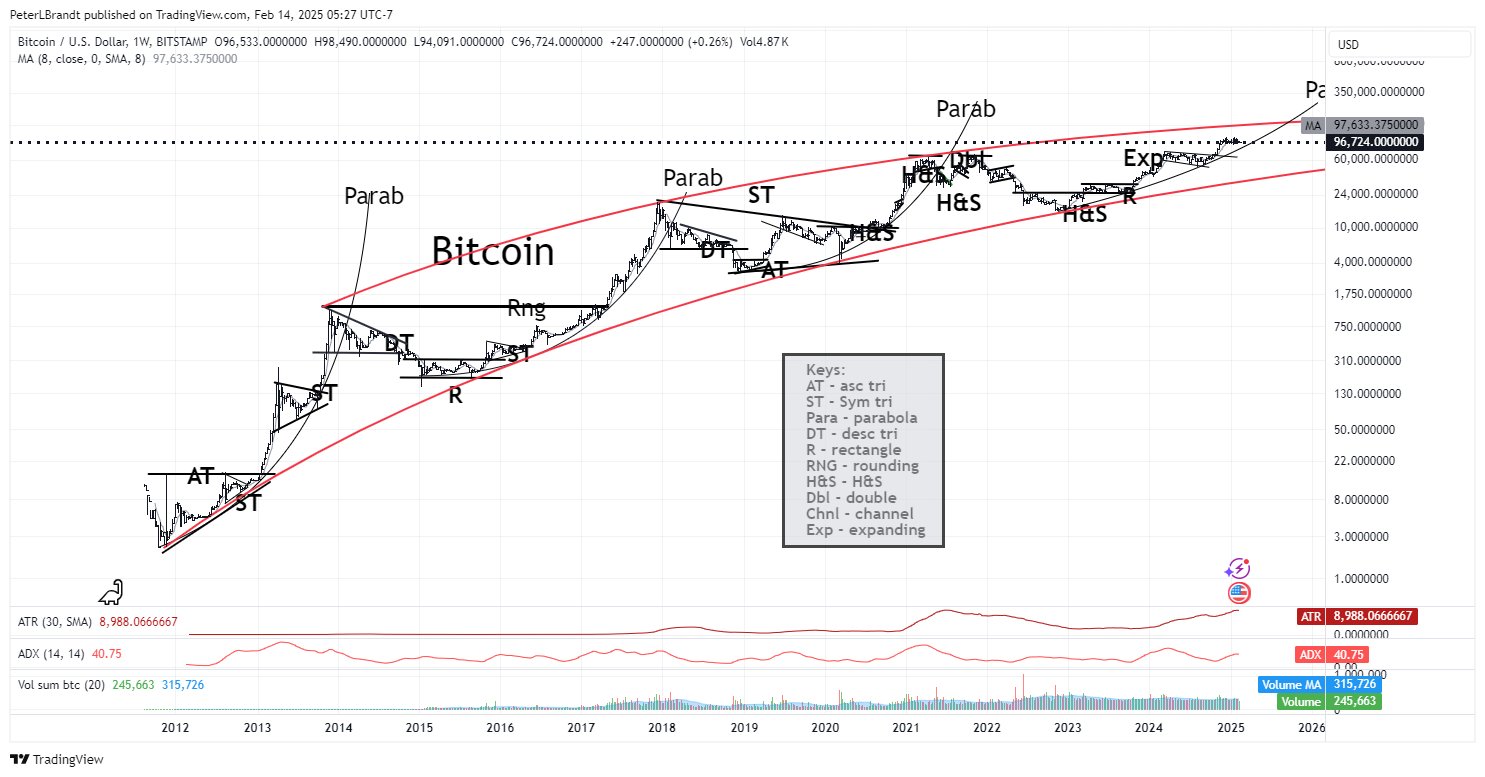

Peter Brandt, a well-respected figure in trading circles, recently shared his skepticism regarding the possibility of Bitcoin reaching $200,000 by the end of this decade. In a post on the platform X, he presented a price chart indicating that Bitcoin must overcome significant resistance levels to attain such heights. Brandt articulated his viewpoint succinctly:

“Unless Bitcoin achieves escape velocity through the upper parabola resistance line, it’s unlikely that BTC will be trading above $200,000 by the end of this decade.”

His thoughts stand in stark contrast to the optimism expressed by numerous crypto analysts who foresee a significant rally for Bitcoin in the forthcoming years. While some analysts believe BTC could surpass six figures, Brandt insists that a formidable resistance level may act as a constraint on its upward momentum.

Brandt Acknowledges Alternative Perspectives

In spite of his reservations, Brandt recently acknowledged a different market analysis that supports a bullish trend for Bitcoin. Crypto analyst known as ‘dave the wave’ shared a projection indicating that Bitcoin could hit the $200,000 milestone during this cycle. Brandt responded positively to this analysis, referring to it as a “mathematically supported narrative,” thus demonstrating his willingness to consider various viewpoints, even while questioning Bitcoin’s potential to maintain an explosive rise past established resistance.

Mixed Sentiments in the Bitcoin Community

The sentiment within the crypto community is divided when it comes to Bitcoin’s long-term trajectory. While a portion of analysts anticipates that increased institutional adoption could propel BTC beyond the $200,000 mark, others remain skeptical, arguing that market cycles may not accommodate such dramatic increases within the current decade.

The ongoing recovery of Bitcoin has reignited conversations about its future movement. As Bitcoin trades near the $100,000 threshold, investors are closely observing whether it will break its resistance or undergo a lengthy consolidation period.

The Immediate Outlook for Bitcoin Prices

Currently, Bitcoin is up approximately 0.4%, exchanging hands at around $97,521, although trading volume has dipped by 2%, reaching $30.5 billion. The cryptocurrency witnessed a 24-hour high of $98,819.47 and has shown a weekly growth of roughly 1.5%. Furthermore, the Open Interest for Bitcoin Futures increased by 0.6%, signaling a rejuvenated sentiment in the market.

Recent forecasts indicate that Bitcoin may hover around the $97,500 level throughout this month. Despite this, a wave of analysts remain bullish, suggesting a potential rally towards $106,000 may be imminent. A recent report has pointed to a target of $103,000, fueled by retail investors who are optimistic despite the present inflation data being hotter than anticipated.

For example, leading market analyst Ali Martinez suggests that Bitcoin is positioned for a positive breakout, potentially reaching $106,000 soon. Similarly, Rekt Capital echoed this sentiment, stating that if Bitcoin can maintain a strong position above the $97,700 threshold, it could further extend its bullish rally.