Crypto Mining Stocks vs. Direct Bitcoin Investment: Understanding the Better Option

Investors are increasingly turning to cryptocurrency mining stocks—such as Marathon Patent Group, Riot Blockchain, and SOS Ltd.—to gain exposure to the thriving cryptocurrency sector. However, the question remains: is investing in mining stocks more advantageous than directly purchasing cryptocurrency? Let’s break it down.

The Evolution of Cryptocurrency Mining

Initially, mining Bitcoin was a straightforward process that could be accomplished using an ordinary laptop. As the network grew, however, the complexity of the computations necessary for mining new blocks surpassed the capabilities of basic devices. This evolution has transformed the landscape of crypto mining significantly.

Understanding the Value of Crypto Mining Stocks

Fast forward to today, and mining Bitcoin has become a specialized endeavor that relies on advanced technology. Miners now utilize ASIC miners, commonly referred to as “mining rigs,” which are specifically designed for the task. The most efficient of these rigs incorporate cutting-edge, high-powered GPUs, such as Nvidia’s 2080 and 3080 models, which have consequently become scarce and expensive.

Why Crypto Mining Stocks Might Be a Smarter Investment

Individual investors across most areas can purchase cryptocurrency directly; however, institutions like banks, investment firms, insurance companies, and hedge funds encounter more restrictions. Due to the relatively nascent nature of the cryptocurrency landscape, many countries lack established legal frameworks that support regulated investments in cryptocurrencies. This situation makes certain mining stocks an attractive alternative.

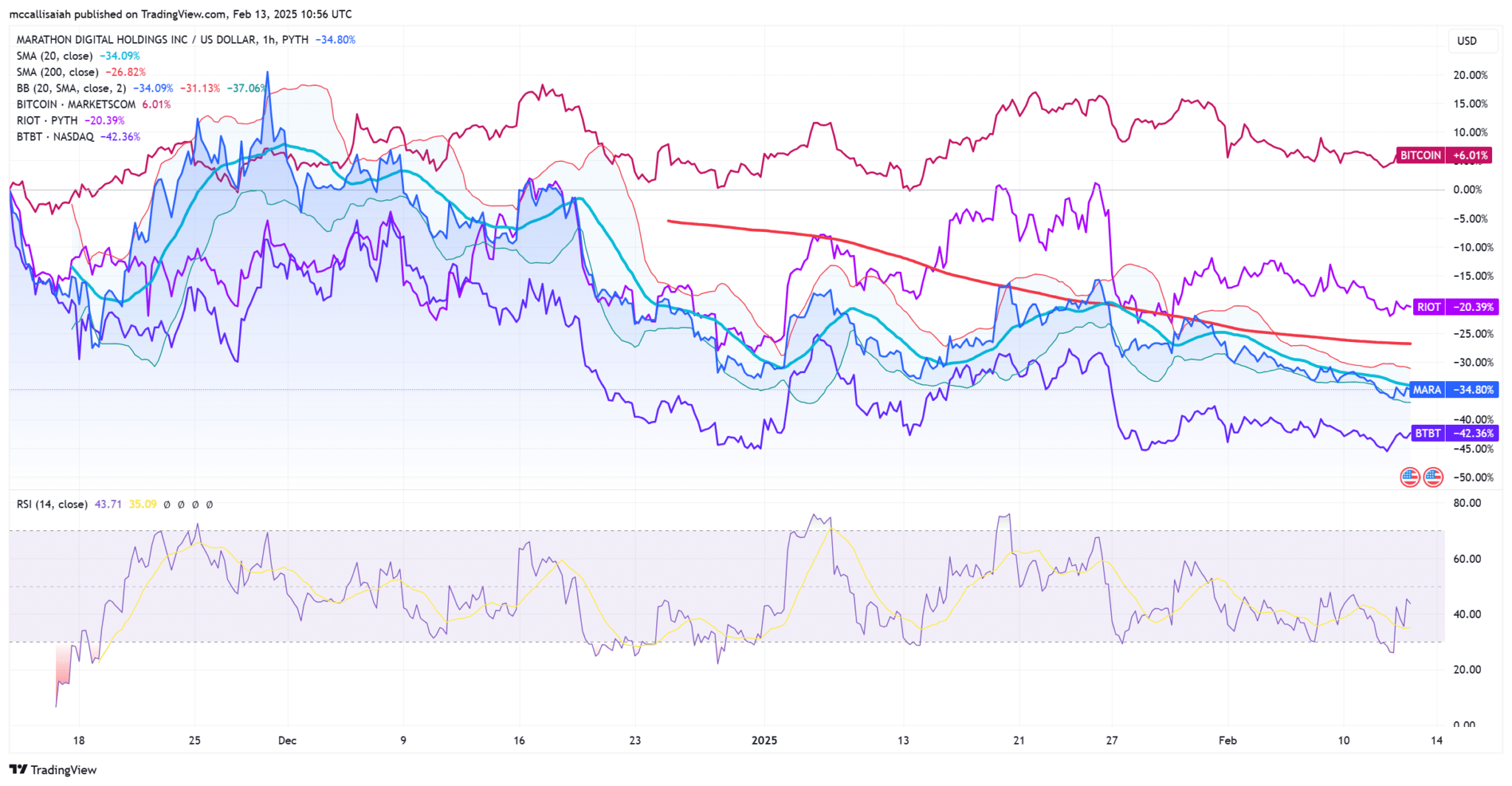

Stocks like Riot Blockchain (RIOT) and Marathon Digital Holdings (MARA) are closely linked to Bitcoin’s price movements, yet they also maintain unique metrics for assessing their performance, including the total amount of Bitcoin mined and the sustainability of their production methods.

Top Mining Stocks to Consider

- Riot Blockchain (RIOT): Operating primarily out of Texas, RIOT remains a prominent player in the mining stock arena. While it may not boast the largest market capitalization, it is a well-recognized name amongst cryptocurrency investors.

- Marathon Digital Holdings (MARA): Leading the charge, MARA showcases an impressive hash rate of 53.2, leaving its competitors behind and solidifying its dominance in the mining power hierarchy.

- Bit Digital (BTBT): Hailing from New York City, Bit Digital made headlines back in 2020 by consistently outshining Bitcoin’s price appreciation quarter after quarter, making it a stock worth watching.

The support for cryptocurrency mining in North America, especially during the Trump administration, has positioned it as a promising hub, allowing these mining stocks to flourish in this dynamic market.

Conclusion: Crypto Mining Stocks as a Complementary Investment

It is vital to recognize that cryptocurrency mining stocks should not be perceived as direct competitors to cryptocurrencies themselves. Instead, they can serve as advantageous supplementary assets that offer distinct use cases within the financial landscape. Stocks such as RIOT, MARA, and BTBT present enticing opportunities for those looking to diversify their portfolios beyond traditional Bitcoin and other major cryptocurrencies.