Is Bitcoin on the Verge of a Rebound? Key Metrics Indicate a Potential Upturn

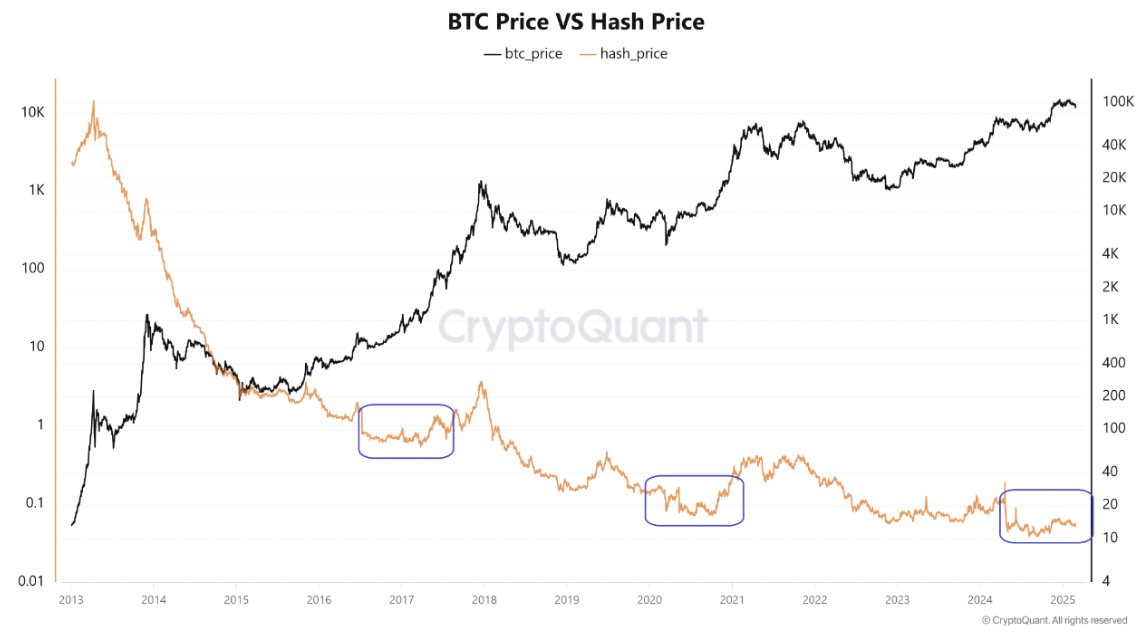

Recent trends in Bitcoin’s Hash Price suggest that the cryptocurrency may be approaching a price bottom, potentially paving the way for a rebound.

Understanding Bitcoin’s Current Status

Bitcoin’s recent fluctuations in Hash Price have aligned with historical patterns, indicating a possible price bottom. As of the latest tracking, Bitcoin is priced at $80,101.35, reflecting a decline of 7.67% in the past 24 hours. Historically, periods marked by lower Hash Prices have typically signified that Bitcoin’s value is nearing a bottom, signaling that a rebound could be on the horizon.

This raises an important question for investors: Could this be an ideal time to accumulate Bitcoin before the anticipated next bull run?

Source: CryptoQuant

Examining Bitcoin’s “in/out of the money” chart sheds light on current market sentiment. Approximately 75.30% of Bitcoin, equating to 14.95 million BTC, remains “in the money,” suggesting that a majority of investors continue to realize profits. Conversely, about 23.23%, or 4.61 million BTC, sits “out of the money,” highlighting the challenges faced by certain holders despite overall profitability.

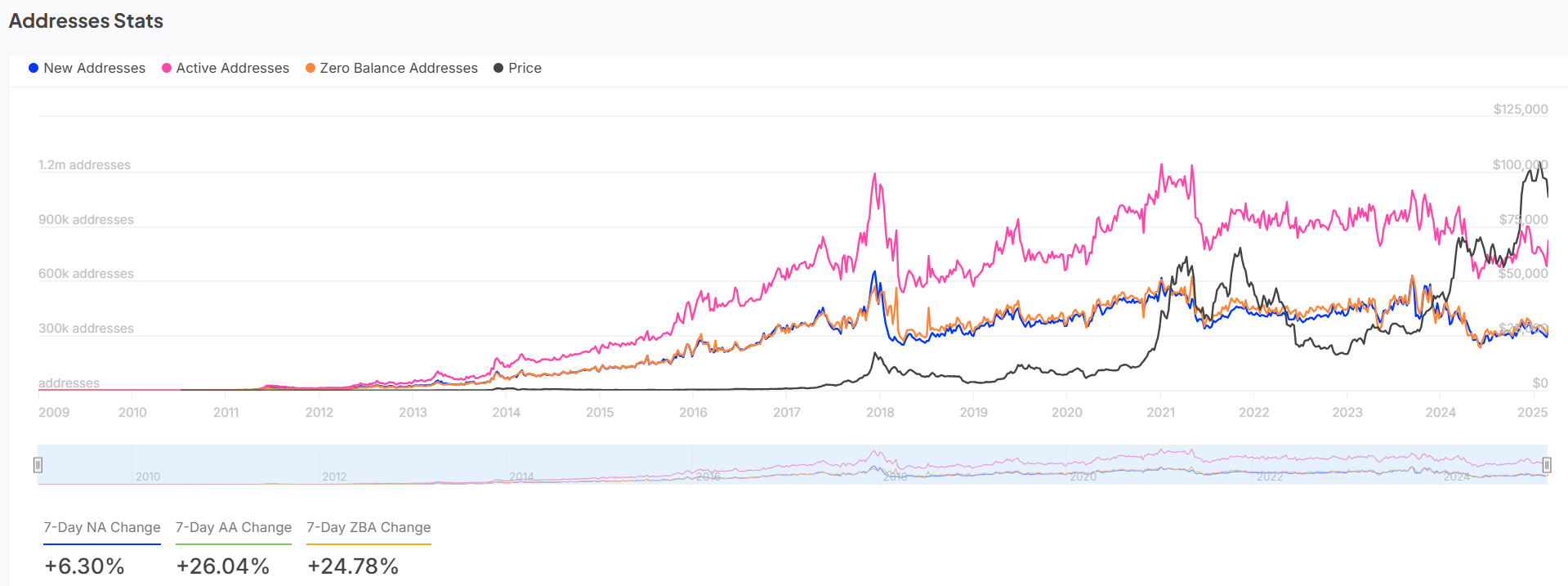

Increasing Activity on the Blockchain

Further insights emerge from Bitcoin’s address statistics, which reveal a 6.30% increase in active addresses over the past week, indicating heightened participation in the network. The pink line in tracking graphs illustrates a steady uptrend in active addresses, which closely parallels Bitcoin’s price movements. Additionally, a rise of 24.78% in zero-balance addresses suggests that many newcomers are actively engaging with Bitcoin, either holding or trading, rather than abandoning their wallets.

This uptick in activity, partnered with a significant 26.04% increase in new addresses, may indicate growing market confidence. If this momentum continues, a price rebound seems plausible.

Source: IntoTheBlock

Technical Indicators Signal Potential Movement

A careful examination of Bitcoin’s technical analysis reveals key support and resistance levels. Presently, Bitcoin is testing support around $80,216, a level that has elicited notable price reactions in the past. However, existing downward trendlines and the breach of critical support levels underline the pressure BTC is experiencing.

Moreover, the Stochastic RSI reading of 2.23 indicates that Bitcoin is oversold, commonly a precursor to a price reversal. The tightening Bollinger Bands further emphasize that volatility may increase in the near future. These indicators suggest that BTC could either rebound from this critical support or continue on a downward trajectory, contingent on market developments.

Source: TradingView

Rising Scarcity and Its Implications

The Stock-to-Flow ratio for Bitcoin has surged by 100% over the last 24 hours, reaching a significant figure of 2.1152M. This increase highlights the growing scarcity of Bitcoin, as the influx of new coins into circulation continues to decline. An elevated Stock-to-Flow ratio typically indicates that, despite short-term price fluctuations, the long-term value proposition of Bitcoin remains robust.

As the rate of new Bitcoin entering the market decreases, scarcity will inherently drive up demand, potentially resulting in higher prices in the future.

Source: CryptoQuant

Looking Ahead: Is a Rebound Imminent?

Based on current analyses, Bitcoin appears to be nearing a potential reversal point. The combination of a declining Hash Price alongside a rising count of active addresses suggests the cryptocurrency is poised for a price reversal. Technical indicators like the Stochastic RSI imply that Bitcoin is indeed in an oversold space, which is typically conducive to increased purchasing activity. As scarcity continues to support its value, sustained interest could lead to a significant rebound.